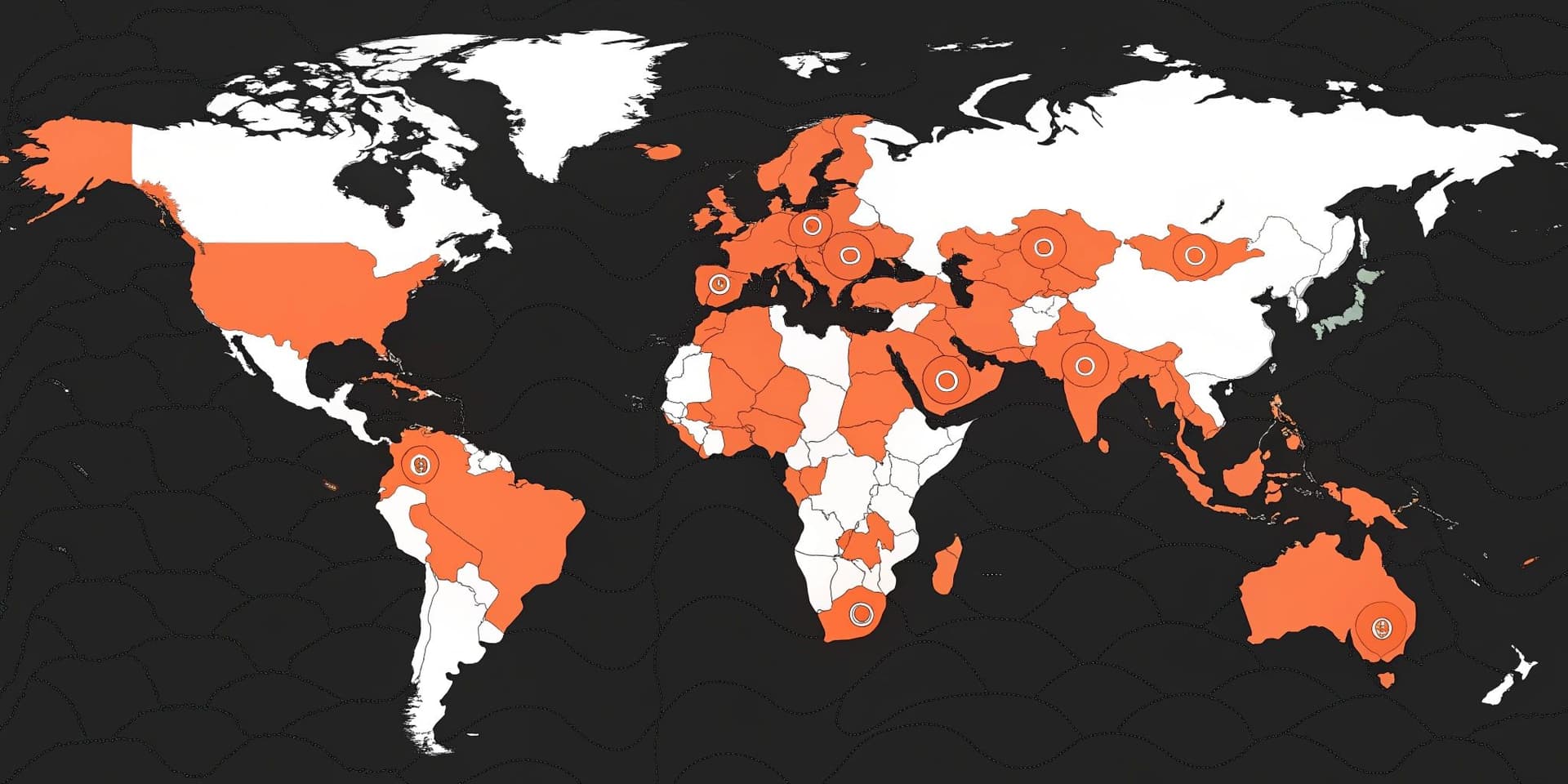

From a wider financial lens, the top 10 countries that use bitcoin are shaping how money moves in 2026. What began as a niche digital asset has moved into mainstream discussions, with governments, banks, and startups reassessing policy and infrastructure. Some jurisdictions accelerate crypto adoption with clear rules and innovation sandboxes, while others remain cautious as they weigh economic risks, liquidity effects, and market stability across the broader cryptocurrency and crypto market landscape.

Stepping back for a moment, why do some places sprint toward crypto while neighbors stall? Different risk appetites, policy priorities, and consumer needs lead to uneven momentum.

Looking ahead to 2026, the big question becomes whether Bitcoin matures into a widely used financial rail or continues to behave like a speculative bet. No matter if you’re deep into trading or just exploring cryptocurrency basics, the coming cycle promises meaningful change to how value is stored and transferred.

Key Drivers Behind Global Crypto Adoption

Taking a measured view, the spread of Bitcoin use is not random; it rides on economics, policy, and technology moving in sync. This shift touches everything from local payments to cross-border transfers, with cryptocurrency gaining traction as a credible digital asset within a modern framework.

Regulation and the Crypto Adoption Index

In many regions, clear rulebooks and a predictable framework open the door for everyday use. When licensing, taxation, and compliance are defined, businesses can launch products and banks can integrate custody. A few countries, by recognizing Bitcoin alongside national money or designing pilot programs, have encouraged innovation, while ambiguous or restrictive approaches tend to slow crypto adoption and mute new services.

Financial Inclusion and Crypto Users

For people outside traditional banking, new rails can help them save, remit, and transact without geographic barriers. Affordable access via phones and simple wallets broadens participation, bringing cryptocurrency to communities that previously relied on cash or informal systems.

Inflation Shocks and Global Crypto Adoption

Where prices rise rapidly and local currencies lose purchasing power, households often seek assets that resist devaluation. In such environments, the use of Bitcoin as a hedge may expand alongside interest in stablecoins for day-to-day spending, providing alternatives during volatile periods.

Tech Readiness and Crypto Businesses

Places with reliable internet, strong smartphone penetration, and thriving fintech ecosystems tend to adopt faster. When merchants already accept digital payments, adding Bitcoin rails and related services becomes a smaller leap for both consumers and businesses.

Policy Support in Crypto-Friendly Countries

Proactive public strategy—whether through sandbox programs, tax clarity, or investment incentives—can speed up market development. Conversely, restrictive measures and uncertainty create hesitation, delay product rollouts, and discourage institutional participation in cryptocurrency.

Trust, Literacy, and the Global Crypto Conversation

As myths fade and education improves, more people understand how wallets, keys, and networks function. This gradual increase in literacy builds confidence, helping the broader public evaluate risks and use Bitcoin in practical contexts.

Top 10 Countries That Use Bitcoin in 2026

Zooming into the leaders, several jurisdictions stand out for momentum and policy experimentation. Governments, payment firms, and retailers are testing integrations, and their progress suggests these markets could headline the next phase of global crypto adoption.

1. United States — Global Crypto Adoption Catalyst

Moving into 2026, regulated platforms and maturing custody will embed Bitcoin deeper into mainstream finance. As institutions gain comfort through clearer guidance and new products such as ETFs, retail and professional investors alike can access cryptocurrency within familiar channels, reinforcing U.S. influence across the global crypto ecosystem.

2. Argentina — Inflation Hedge for Bitcoin Users

With persistent price instability weakening the peso, many residents look to Bitcoin to protect savings. Through 2026, households and small businesses may increasingly treat BTC as a reserve-like asset, complementing local options and offering a buffer during uncertain cycles.

3. El Salvador — Policy Pioneer in Crypto Adoption

Since establishing Bitcoin as official money, the country has promoted everyday use and tourist spending. As infrastructure matures, broader participation by merchants and citizens could cement its role as a regional example of how a cryptocurrency strategy might be implemented at scale.

4. United Kingdom — Crypto-Friendly Countries Momentum

With policy refinements and growing institutional interest, the UK is positioning itself as a hub for digital finance. Clearer compliance paths can attract startups and financial firms, aiding Bitcoin’s integration with established services and expanding the local user base.

5. Bhutan — Clean-Energy Mining and Businesses in 2026

Leveraging abundant hydro resources, the country has explored energy-efficient mining. By utilizing renewable power, Bhutan could align sustainability targets with crypto growth, bringing new revenue streams and technical capacity into its economy.

6. Nigeria — Crypto Users Driving Everyday Utility

A young, mobile-first population has rapidly experimented with digital wallets. As tools become simpler and fees decline, peer-to-peer activity and small-business payments may keep rising, reinforcing Nigeria’s role in Africa’s Bitcoin story.

7. Vietnam — Rising Crypto Ownership in Southeast Asia

Strong interest in digital assets, coupled with high mobile adoption, supports vibrant trading and payments experimentation. Continued growth in wallet use can push Bitcoin further into daily financial habits by 2026.

8. Brazil — Top 10 Countries Expanding Use

With a large economy and evolving policy stance, Brazil has laid groundwork for broader uptake. As crypto businesses navigate clearer guidelines, more consumers may explore Bitcoin for diversification, transfers, and long-term saving.

9. China — Global Crypto Adoption Signals

Backed by advanced infrastructure and vast scale, the market’s stance remains influential for mining, hardware, and investment flows. Regulatory developments through 2026 will shape how Bitcoin interacts with local systems and global liquidity.

10. India — Crypto Adoption Index Potential

A massive, tech-forward population and rising awareness are setting the stage for growth. As rules evolve and financial literacy expands, more users could incorporate Bitcoin into savings and remittances alongside conventional channels.

Bitcoin’s Next Chapter: Crypto Adoption Index 2026 and Beyond

Heading into 2026, institutional participation is likely to broaden, turning BTC from a niche trade into a recognized financial tool. Clarity around compliance can strengthen confidence for transactions and investment, while Layer-2 advances—such as the Lightning Network—address throughput and fees, improving everyday usability within the cryptocurrency economy.

Emerging markets across Latin America, Africa, and Southeast Asia may see continued traction as people seek protection against inflation and better access than legacy rails provide. Reports from analysts and data firms, including sources like Chainalysis, often highlight momentum in regions where banking access is limited yet mobile adoption is high.

On sustainability, miners are increasingly tapping renewables, reducing environmental concerns. Privacy improvements, better custody, and interoperability with banks can further normalize Bitcoin as both a store of value and a functional payment option, connected to the wider crypto market that also includes instruments like stablecoins and ETFs.

Summing Up: Insights From the Global Crypto Report

Across the next cycle, an alignment of regulation, infrastructure, and education can carry Bitcoin deeper into daily life. With more institutions participating and technologies maturing, the path from early experimentation to stable usage looks increasingly attainable in 2026.

Markets that nurture innovation while maintaining safeguards are likely to see stronger inclusion and resilience. Builders of secure platforms and services help translate policy into practice, enabling broader participation under evolving frameworks, including MiCA in Europe and other regional standards. As this ecosystem expands, the story of Bitcoin continues to reshape how value is stored, moved, and measured worldwide.