Ghana has moved a step closer to restoring macroeconomic stability after its parliament ratified a $2.8 billion agreement to reorganize part of the country’s external liabilities. The decision represents a key milestone in efforts to recover from a financial crisis that led to a sovereign default in late 2022.

Years of mounting fiscal pressure, intensified by global disruptions, forced the government to suspend payments on much of its foreign debt. The restructuring initiative is designed to realign repayment obligations with the country’s economic capacity.

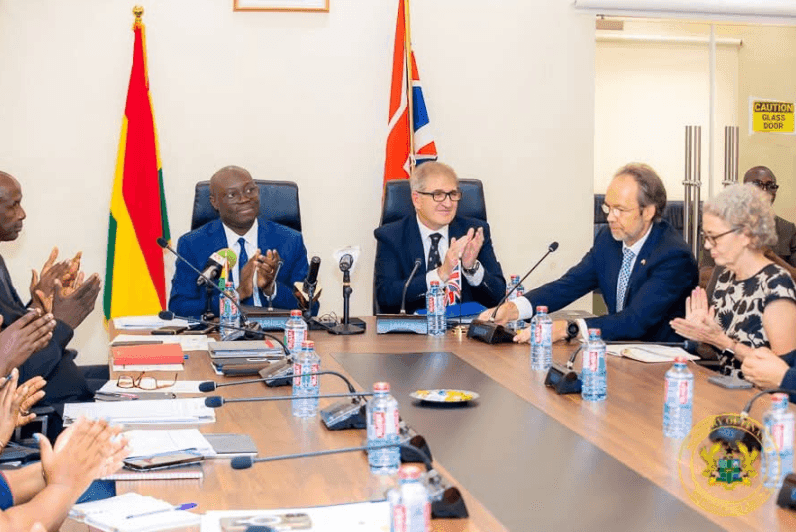

Framework agreed with official lenders

Earlier this year, Ghana reached a formal understanding with 25 bilateral creditor nations, among them China and France. The newly endorsed package restructures $2.8 billion owed to these governments.

Under the plan, authorities aim to lower the public debt burden to 55 percent of gross domestic product by 2026. In parallel, they intend to gradually reduce the share of state revenue allocated to debt servicing to under 18 percent beginning in 2028.

Talks continue with bondholders

Beyond official creditors, negotiations are still underway regarding approximately $2.7 billion owed to private investors. Finance Minister Cassiel Ato Forson has confirmed that discussions are progressing, with the objective of aligning private-sector terms with those secured from bilateral partners.

The fiscal crisis emerged against a backdrop of pandemic-related spending pressures, global supply chain disruptions linked to the conflict in Ukraine, and sharply rising borrowing costs worldwide. These factors collectively weakened public finances and foreign currency reserves.

Commodity strength and reform ambitions

As a major exporter of cocoa and gold, Ghana’s economic outlook remains closely tied to commodity performance. Policymakers believe that stabilizing debt metrics will help rebuild investor trust, ease financing constraints and create room for social and infrastructure investment.

The parliamentary vote signals broad political support for corrective measures, as the government seeks to reposition the economy on a sustainable growth path after one of the most turbulent financial periods in its recent history.